As Housing Employment Adjusts, Retail and Mortgage Origination Quickest to Re-Align

Tuesday, April 25, 2023 by Kevin Kaczmarek

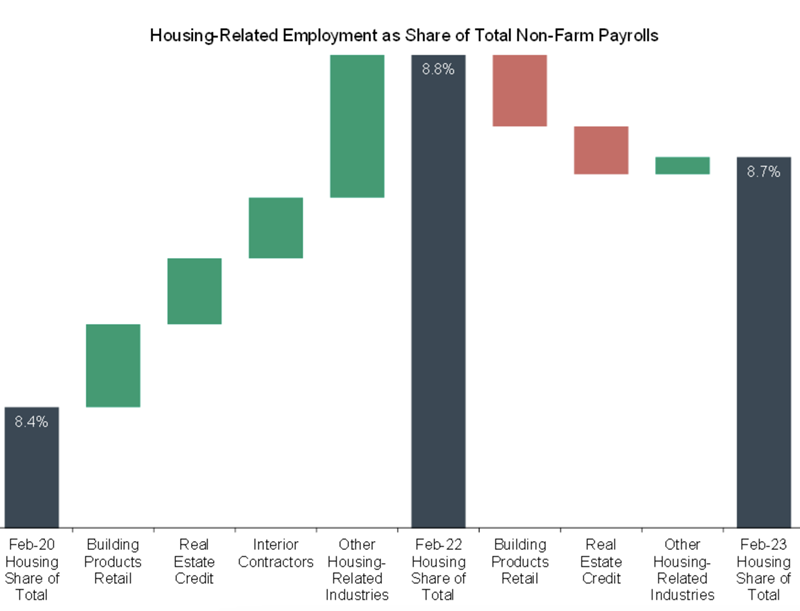

Housing-related employment growth has now lagged overall employment for 22 consecutive months on a year over year basis but, despite the dramatic increase in interest rates over the past year or so, has remained positive at 1.7% as of February, the latest data available. This housing-related employment data spans nearly 70 industries within the construction, distribution, financial services and manufacturing sectors, comprising 13.4 million jobs, or 8.7% of total non-farm payrolls, down 10 basis points year over year but still 25 basis points above the pre-pandemic level three years ago.

Perhaps not surprising to those familiar with the housing space, the difference in performance amongst the various industries has been quite striking of late. For instance, in the two years between February 2020 and February 2022, housing-related employment expanded relatively rapidly, growing 1.6% annually versus a 0.5% contraction in total non-farm payrolls, pushing housing-related employment to 8.8% of the total. Building products-related retail, notably homecenters, mortgage originators, and a variety of interior contractors such as plumbing and HVAC drove over half of share gains, with the remaining gains spread across a broad swath of other housing-related industries.

However, as the residential real estate industry has softened substantially over the past year, some of these trends have reversed. For instance, building products-related retail and mortgage origination employment declined 3.0% and 15.2% year over year in February, driving a ten basis point contraction in the share of housing-related employment relative to the total, as these industries have been willing and able to move quickly to re-align their cost bases with lower demand. Notably, as we wrote in our latest Macro Mortgage Forecasts, mortgage origination likely has more right-sizing to do.

Interestingly, the remaining housing-related industries, in aggregate, continue to grow at a healthy clip despite the pullback in residential transaction volumes. For instance, interior contractor employment, which includes occupations like plumbers and electricians and comprises 27% of total housing-related employment, increased 3.3% year over year in February, in-line with total non-farm payrolls. Going forward, it appears a handful of industries may be able to maintain positive growth for the time being, especially those with more exposure to skilled trades, where labor shortages are more difficult to remedy in the short term, as well as those with more exposure to commercial construction where timelines and backlogs can extend for multiple years.

Tuesday, April 25, 2023 by Kevin Kaczmarek

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey