Number of Real Estate Agents Drifting Lower, Following Expected Path

Thursday, May 25, 2023 by Ryan McKeveny

Filed under: macro housingreal estate services

In a blog post on a similar topic in late 2021, Labor Shortages Abound, Not So For Realtors Chasing Robust Pricing, we commented that agent count at the time had “reached its highest level ever, with 8-9% year-over-year growth each of the last six months also representing the strongest rate of expansion since 2006…[although] the cautionary consideration is whether this recent surge in agent count is another signal of peak sentiment and activity, as it was last cycle.” On one hand, that cautionary view was correct; on the other hand, the reduction in agent count has been fairly modest thus far, down 1% year over year and down 4% from the all-time high in October 2022. Through a broader lens, NAR membership count this April still equated to 1.0% of total non-farm payrolls in the U.S. While down six basis points from this ratio’s all-time high from 2H21, it remains well ahead of the 0.7% average since 1980.

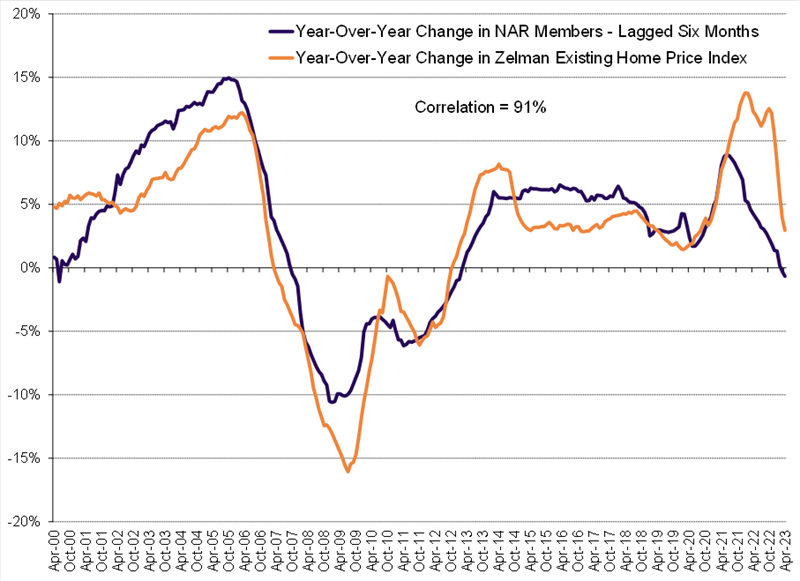

As highlighted in our latest Macro Existing Home For-Sale Forecasts, given our expectation for relatively weak trends to persist for existing home sales and home prices in 2023-24, we expect agent count to progress lower given high correlations to macro housing data. Intuitively, sharp reductions in the number of transactions would be expected to be the key driver of agent count. In reality, the correlation between the year-over-year change in agent count and existing home sales is not overly robust – with a maximum correlation of 51% when lagging agent count 16 months behind home sales. The relationship is much more significant between agent count and home prices, with a 91% correlation between the year-over-year change in agent count and existing home prices on a six-month lag. In other words, the data suggests that changing home values are the most important macro factor bringing agents into or out of the industry.

Setting aside the consequences of depressed housing activity on the overall economy, a silver lining to the downward trend in agent count is that per-agent productivity in the brokerage industry should improve as the froth is syphoned out of the market. While history would suggest that many brokerages will remain most focused on agent recruitment and retention as their primary means of sustaining or growing market share, we believe the healthier balance is quite clearly a smaller but more productive workforce, given the downstream benefits of cost efficiencies and better operating leverage. Time will tell whether the game remains the same as the past, or if the current downturn will set the stage for greater productivity and efficiency in future years.

Thursday, May 25, 2023 by Ryan McKeveny

Filed under: macro housingreal estate services

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey