Student Loan Debt Looming as Affordability Constraints Stretch Further

Thursday, July 13, 2023 by Alan Ratner

Filed under: affordabilityhomeownershipmillennialsmortgage ratesstudent debt

Looking forward, several of our homebuilding contacts have voiced concerns surrounding the affordability impact of the upcoming resumption of federal student loan payments on October 1st. While these payments have been incorporated into mortgage underwriting during the deferral period, they obviously have not been paid by consumers since 2Q20, providing a significant affordability tailwind over this time frame.

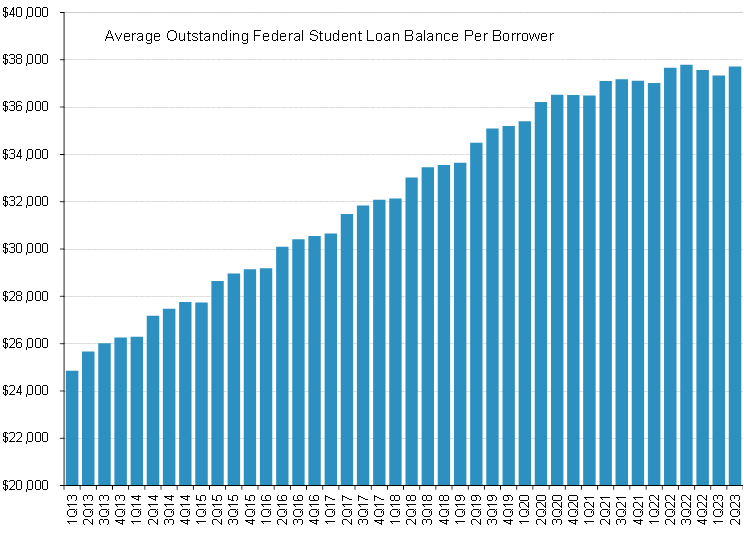

As of 2Q23, 44 million borrowers had student loan debt that will resume payments in October. The aggregate federal loan balance outstanding currently stands at $1.64 trillion, representing an average of $37,000 per borrower. We estimate this amounts to average monthly payments of $400-500, more than offsetting the benefit of mortgage rate buydowns from a cash flow perspective for those borrowers with student loans. According to data from the Federal Student Aid Portfolio, 34% of 18-29 year olds have some student loan balance, followed by 22% of 30-44 year olds, 7% of 45-59 year olds and just 1% of 60-plus year olds.

Thursday, July 13, 2023 by Alan Ratner

Filed under: affordabilityhomeownershipmillennialsmortgage ratesstudent debt

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey