Faith, Not Fundamentals: The Apartment Sector’s Defining Conflict in 2026

Friday, January 23, 2026 by Mark Franceski

Filed under: apartments

On the one hand, optimism abounds for a more liquid transaction market this year as capital allocators have plentiful funds, clear mandates, and a firmly positive stance toward the near-to-medium-term direction of the sector. For example, trailing 12-month transaction volume has increased on an annual basis for 14 consecutive months, despite essentially no change to cap rates.

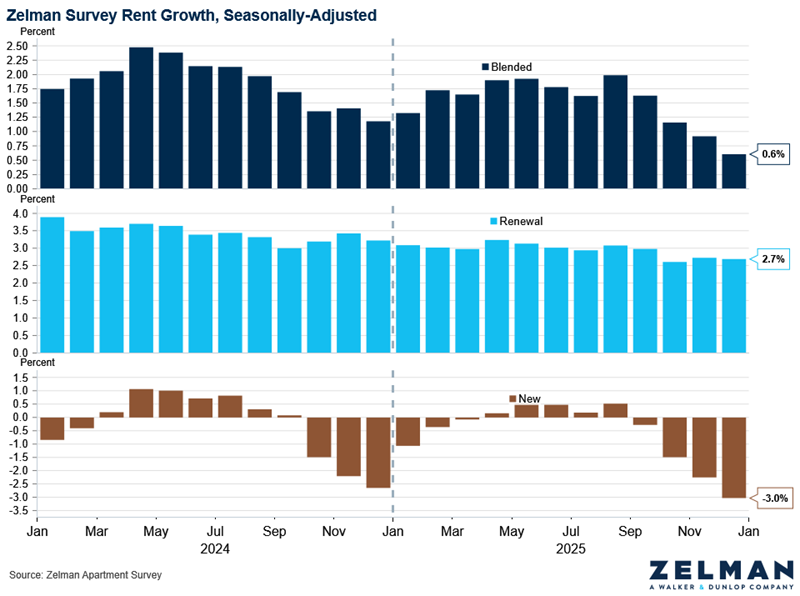

On the other hand, operating fundamentals are markedly soft and have shown barely any sign of improvement through the end of 2025. For example, results from our December apartment operators survey, published this week, showed the weakest new move-in rent growth in survey history, despite an already-weak fourth quarter and a lackluster year overall. In other words, expectations for improvement will have to be taken on faith. Furthering the revenue generation woes, occupancy is also well below historical norms — sub-93% in our survey and corroborated by other sources.

The connection between these two market elements is obvious – the net operating income generated by apartment properties generate the financial returns investors seek – but the vibes between the two are rarely this divergent. Buyers are hungry for more deal flow and anticipate the resumption of pricing power now that peak supply is firmly in the rearview mirror. However, apartment investing, like so many other investment options, boils down to the income stream. And if that income stream becomes nothing more than a slow trickle, 2026 could be another year in the wilderness for the multifamily sector.

Friday, January 23, 2026 by Mark Franceski

Filed under: apartments

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey