“Steep Slowdown” on the Horizon for Home Improvements?

Friday, July 26, 2019 by Zelman & Associates

Filed under: home improvementsurvey

Last week, The Joint Center for Housing Studies of Harvard University (JCHS) released its Leading Indicator of Remodeling Activity (LIRA) with a concerning headline: “Steep Slowdown Projected in Home Improvements.” We first wrote about the LIRA in September 2017: “LIRA a Home Improvement Resource with Limitations Worth Recognizing.”

The LIRA is benchmarked to American Housing Survey (AHS) results. As a reminder, this survey is only conducted every other year and those intermittent results are released with an 18-month lag. Given the timing of the AHS, all quarterly data points for the LIRA from 1Q18 forward reflect what should have happened based on a regression model versus confirmation of actual activity.

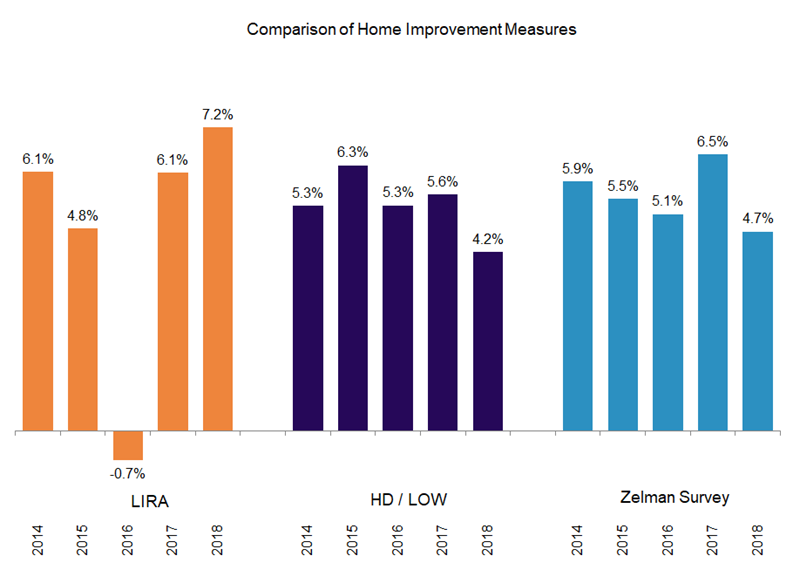

Before we consider the cautionary outlook of the latest LIRA, it is important to recognize the alignment of historical estimates with other market measures. With last week’s release, 2016 and 2017 were re-benchmarked to incorporate the 2017 AHS. Thus, 1Q16-4Q17 estimates of home improvement activity were restated. The LIRA model now estimates a 0.7% contraction in 2016 spending versus its prior estimate of 6.2% growth. Such a view dramatically conflicts with domestic same-store sales growth of 5.3% for The Home Depot (HD) and Lowe’s Companies (LOW) as well as 5.1% growth for our home improvement revenue index published in our monthly Building Products Survey.

There is less variation in 2017 growth figures with LIRA at 6.1% versus 5.6% for HD/LOW and 6.5% for our data. For 2018, LIRA’s estimates are driven by its regression model. We believe that it overstates growth, estimating a 7.2% increase versus 4.2% for HD/LOW and 4.7% for our index. According to the LIRA release, the period ended 4Q18 was the most robust four-quarter average since 1Q07 even though results for HD, LOW and our survey all decelerated in 2018 from 2017. In short, although we respect the JCHS’s process, we cannot confidently rely on its outlook given the unreliable nature of historical estimates.

Based on the results of our latest Building Products Survey and our analysis of the overall home improvement market, we estimate aggregate domestic same-store sales growth of 2.5% for HD and LOW in fiscal 2Q19, leaving 1H19 at 3.0%, the softest half-year period since 1H12. We anticipate modest acceleration to 3.6% in 2H19 and 3.8% in 2020. Although this would still trail the 4.3-6.4% range from 2013-18 as moderating home price appreciation and high-end housing softness mitigate a return to more robust growth, it offers the other end of the “steep slowdown” spectrum.

Friday, July 26, 2019 by Zelman & Associates

Filed under: home improvementsurvey

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey